Who thought we’d still be in the grip of the pandemic more than two years after it first came ashore—yet here we are. Indeed, there are many ways people would like things to get back to “normal,” whatever that is or was.

As with every major tectonic shift, the pandemic has brought out new ways of doing things and changed old ways—and in a number of cases likely for good. For example, prior to the pandemic, 1 in 67 jobs was done remotely. Now it’s 1 in 7. Experts at LinkedIn who track these trends believe that much of this shift will stay with us.

As recently as 12 months to 14 months ago, the average person probably couldn’t define supply chain, much less understand it’s complexity and impact on our daily lives. Now it’s front-page news almost every day.

In the meantime, the impact on transportation has been profound, and it’s not restricted to any single mode. All have been affected, and the biggest single driver is the shift from business-to-business (B2B) to business-to-consumer (B2C), as home delivery shot upward when people simply couldn’t get out to physical stores.

The pandemic wasn’t the only driver of expanded consumer demand. Related government benefits (cash checks, extended unemployment benefits) and rising wages all enabled a strong consumer buying spree. This was pushed upward further, in part, because people were at home and had the time and interest in spending on themselves, their kids and their homes.

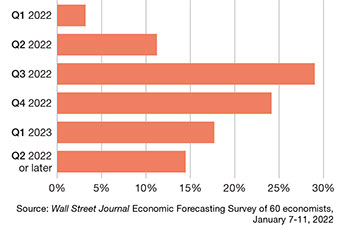

When do you expect supply chain disruptions to have largely receded? (% of respondents)

Source: Wall Street Journal Economic Forecasting Survey of 60 economists, January 7-11, 2022

So, what about recovery? Debates are all over the place on when things will achieve some semblance of normality. A recent Wall Street Journal poll showed a significant percentage of those surveyed didn’t see recovery taking place until sometime in the span of the third quarter of 2022 to the first quarter of 2023, so expect to be dealing with these same issues for quite some time to come.

I just don’t know why things can’t go back

to normal at the end of the half hour,

like on Brady Bunch or something.

— Lelaina Pierce, Reality Bites (1994)

To kick off Logistics Management’s annual e-commerce issue, we rounded up a number of industry analysts who follow the major modes most affected by the current state of the supply chain to ascertain their views of the situation as well as what’s on the near horizon. If there’s any consensus it’s that there is no consensus on how this will unfold or what the next phase of the pandemic impact will be.

We do know that this is a particularly difficult time for shippers, with challenges across all the modes, increasing prices, tight capacity, backlogs of ships and the continuing shift to e-commerce and home delivery.

Parcel

Parcel has seen the greatest impact, simply due to the major shift to home delivery. According to Satish Jindel of SJ Consulting, 69% of parcels now weigh less than five pounds and will fit in a typical mailbox.

This bodes well for the beleaguered United States Postal Services (USPS). Because they’re required, by law, to go to every address (all 159 million) every day, they have an ideal distribution network for these types of shipments, whether they’re being shipped via USPS or via another provider using USPS for last-mile delivery.

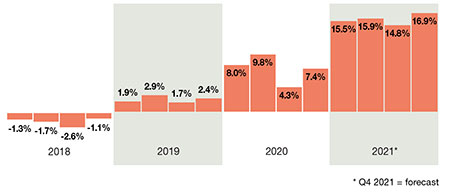

Monthly ground parcel rate per package index (January 2018 as base)

Source: Cowen/AFS Freight Index

Ground parcel rate per package freight index (January 2018 as base)

Source: Cowen/AFS Freight Index

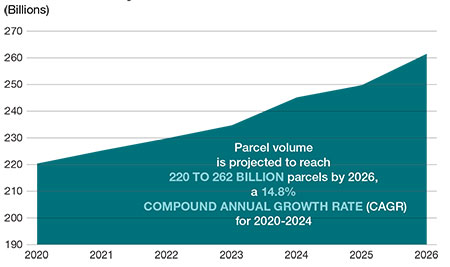

Parcel volume by 2026 (Billions)

Source: Pacola

“The B2C parcel market is much more than just a difference in addresses, as deliveries shift to residences from offices,” says Jindel. “The B2C market is more like the 31 flavors at an ice cream parlor, whereas the B2B market is more like the three flavors found at family restaurants.”

Jindel observes that Amazon unleashed the power of “free” by offering free shipping to consumers. This has become a key differentiator for buyers in terms of who they order from and how it’s shipped. With online sales growing exponentially, the B2C share of the parcel market grew from 20% in 2000 to over 70% in 2020—and is only predicted to continue expanding.

Although currently moderating from 2020 levels, residential now accounts for almost 30% of total shipments in 2021, a 32% change compared to 2018. According to parcel industry veteran Brian Broadhurst: “There’s no question that the rise in direct-to-consumer shipments has enabled an unprecedented number of new entrants in the final-mile space, backed by record funding.”

Broadhurst also points out that, regardless of mode of transportation, the customer expects e-commerce goods quickly. “This has caused an upstream effect where companies are positioning their inventory across more facilities and markets to meet customer demands,” he says. “Companies have responded by adding local and micro-fulfillment centers, moving inventory traditionally in one large distribution center to a greater number of local facilities. This creates more shipping lanes, many of which are candidates for lower-volume modes.”

Of course, the flipside of all the B2C ordering is the C2B reverse logistics, which is rapidly expanding as people shop for selections and return what they don’t want. The cost of this ultimately will appear in the pricing in some fashion, but it does remain a vital part of successful e-commerce transactions.

Trucking

Trucking is affected as well, but in different ways for different segments of the business. For one, the demographics in the truck driver population are not favorable, with the average profile putting them in the high-risk category for COVID, which is exacerbating the driver shortage.

In addition, regulations, such as those in California requiring all commercial trucks meet the new emission standards by 2023, is hitting the intermodal drayage segment particularly hard, which is affecting capacity and ocean terminals as well as railheads.

Less-than-truckload (LTL) is the other key segment seeing a favorable impact. In fact, rates and margins are rising and stocks are trading at multiples never before seen. A large driver of this is the middle-mile segment relating to e-commerce.

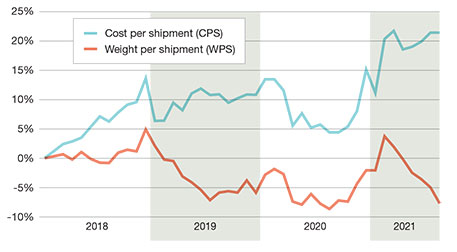

LTL cost per shipment and weight per shipment (January 2018 as base)

Source: Cowen/AFS Freight Index

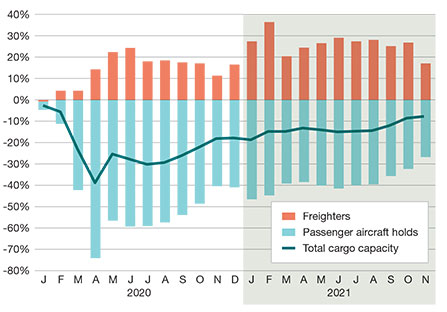

International ACTKs (% change versus same month in 2019)

Source: IATA Economics using data from IATA monthly statistics

In Jindel’s opinion, Amazon could basically serve the entire country with two-day service from eight fulfillment centers (even though they’d have to be 20-million square feet), but instead they’re operating about 160 facilities. The net effect is less full truckload going into these facilities—the middle-mile volume between sourcing and final-mile—and a rise in LTL volume to serve these centers.

LTL rates increased in 2021, largely as a result of capacity-driven carrier rate hikes. With capacity issues persisting through the holiday season, LTL rates remained high and reached a new historic high of 32.3% in the fourth quarter of 2021. With a high concentration of LTL shipments handled by relatively few carriers, the rate pressure is expected to continue in the foreseeable future.

Another key element is the rise of e-fulfillment operators. The rapid growth of on-line “e-tailing” has created a need for many of these non-brick and mortar companies to look for help in fulfilling order deliveries to customers.

Easy venture money has helped fund a number of these companies that operate a big box DC serving large numbers of e-tailers, which simply don’t have the resources to provide adequate fulfillment services on their own.

Air cargo

Air cargo difficulties stem largely from the drastic reductions in belly space congruent with the reductions in passenger air schedules due to the pandemic. This has driven up the cost for the relatively scarce freighter capacity.

According to IATA, in November 2021, carriers based in North America posted an 11.4% increase in international cargo ton-kilometers (CTKs) versus the same month in 2019, down from 20.3% in October. Inflation, which reached 6.8% year-on-year in the United States in November, is hurting consumers while congestion issues at several key gateways have added to headwinds for cargo volume.

Amazon, of course, has entered the air cargo business on a grand scale. Not only have they built their own substantial fleet of freighters (95, plus eight on order as of December 2021), but they also hold warrants to acquire a minority stake in Atlas Air’s parent company, Atlas Air Worldwide Holdings. This certainly bears watching as they continue to be a force across the supply chain.

What next?

So, what should shippers do to deal with all of this? One of the major shifts needs to be away from the traditional transportation sourcing exercises of annual bids—the concept is simply outdated in the face of market volatility.

Shippers need to continuously evaluate their service networks, ensuring adequate capacity at the best possible price. Doing this without decision support technology that drives access to real-time network intelligence and performance analytics is akin to fighting a forest fire with a garden hose.

As Jim Tompkins, founder and chairman of Tompkins International, wrote in the December 2021 issue of sister magazine Supply Chain Management Review: “The legacy view of supply chain must be replaced by a real-time, end-to-end, collaborative network that ensures all parties have access to a single version of the truth.”

Having capabilities in real-time of network intelligence, driven off real-time data relating to network performance, offers much great visibility to what’s going on and how to respond to the changes in capacity, service, and price.

packers and movers bangalore

packers and movers bangalore near me

packers and movers bangalore cost

packers and movers bangalore to hyderabad

packers and movers bangalore price

packers and movers bangalore marathahalli

packers and movers bangalore to chennai

The post E-commerce Effect: Change for the better first appeared on shrisaimovers.

Packers And Movers Banashankari Bangalore a Packers And Movers Banashankari Bangalore a Packers And Movers Jayanagar Packers And Movers Jayanagar Packers and movers Packers and movers in peenya Packers and movers in peenya Packers and movers near me Packers and movers near me Yelahanka Packers and movers Yelahanka Packers And Movers Btm Layout Packers And Movers Btm Layout Packers And Movers Koramangala Packers And Movers Koramangala Packers And Movers Hsr Layout Packers And Movers Hsr Layout Packers And Movers Bommanahalli Packers And Movers Bommanahalli Packers And Movers Begur Road Packers And Movers Begur Road Local Packers And Movers Bangalore Local Packers And Movers Bangalore Packers And Movers Ramamurthy Nagar Packers And Movers Ramamurthy Nagar Packers and movers Bangalore Packers and movers Bangalore